What FE International, MicroAcquire, Flippa and Empire Flippers say about themselves – and each other

Over the last few months, leading M&A advisors, acquisition marketplaces and curated marketplaces have all shared insight into how their business models – and their clients – are performing.

Through formal reports, blog posts, Twitter conversations and more, businesses like FE International, Empire Flippers, Flippa and MicroAcquire have been offering up an inside look at their businesses. This information is particularly useful for business owners who may be deciding which route to take when planning an exit strategy.

It’s important to look into the marketplace’s or M&A advisor’s experience and make sure it’s a good fit for your situation. We recommend considering the following:

- Do they understand your business model?

- Do they know how to value and market businesses like yours?

- Do you need a marketplace, or M&A advisor?

- Are the types of buyers they represent right for your business’ customers long-term?

You’ve spent a significant amount of time building this business; you don’t want it to end up in the wrong hands.

To help you, here are a few questions and answers you should know about each of the above businesses, as reported from information on their own and competing websites and social media pages:

Are They Buyer- or Seller-Centric?

Is the marketplace or M&A advisor you are looking at buyer-centric or seller-centric? The various marketplaces and M&A advisors are all set up differently. The main difference between an advisory firm and an acquisition marketplace with respect to focus is this: most marketplaces are there to represent buyers and sellers alike, whereas an M&A advisor will only work for a buyer or a seller (not both).

Because of this, marketplaces do not necessarily have a vested interest in your success. They set themselves up with very low input costs to a sale process, whereas a good M&A advisor will invest in due diligence, accounting, marketing, legal and other costs along the way. Thus, a good M&A advisor will put in the effort to see a return on that investment.

MicroAcquire, a micro-start-up acquisition marketplace, charges buyers a $390/year fee to join its platform with premium access. In exchange for its zero-fee approach to sellers, it prioritizes the buyer experience and offers no services to sellers.

While the platform is 100% free for sellers, you can use the platform’s “white glove” acquisition service for a 5% fee. This service helps you manage your acquisition including marketing, matchmaking, and transfer. However, it’s only available to businesses with $1 million+ TTM.

If you are a seller who is looking to exit for a high multiple, an acquisition marketplace such as MicroAcquire is probably not a good fit for you and your business. MicroAcquire is also the new kid on the block, aiming to take on Flippa.

Flippa is a marketplace like MicroAcquire; however, they offer a la carte upgrade options on their platform. They charge both buyers and sellers – the latter through a listing fee, upgrades along the way for more exposure, and a commission on sale. They also have buyer services, charging 2.5% on a successful purchase. This means they may in fact get paid on both sides of the same transaction, causing a conflict of interest.

Empire Flippers is a curated marketplace, requiring buyers to verify their identity and provide proof of funds through their platform. They no longer charge a listing fee like the other marketplace platforms, but take a fee based on the listing price of the business. They charge this once the business is sold. Empire Flippers states that they will promote your listed business to thousands of buyers and “help you weed through the tire-kickers to find real investors.” These factors make EF a more seller-centric platform than marketplaces like MicroAcquire and Flippa. For owners in the 5- and low 6-figure space, this can prove to be a pain-free way of selling for a reasonable multiple.

FE International, an M&A advisory firm and thus unlike the aforementioned platforms, is focused solely on sellers, assisting them with audit, due diligence, marketing, negotiations, legal drafting and other services to secure successful exits. FE follows a more traditional acquisitions approach to target qualified high net worth individuals, private equity firms, funds and strategics (of which they have c.80K in their network), opting for one-on-one pitching to garner competitive offer situations for their clients to drive up multiples and secure favorable terms. For high 6-, 7- and 8-figure businesses, this seller-centric approach is far more conducive to a successful outcome.

What Types of Businesses Do They Work With?

Another consideration is the marketplace’s or M&A advisor’s experience closing deals like yours. Not all online businesses are alike, and just because a platform or advisor has past online businesses as clients doesn’t mean they are well-equipped to take on your business.

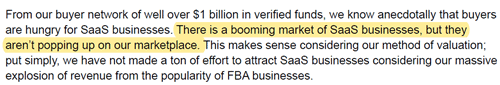

For example, according to their 2021 State of the Industry report, Empire Flippers, a curated marketplace, had very few SaaS deals in 2020. They write, “There is a booming market of SaaS businesses, but they aren’t popping up on our marketplace.”

When looking at Flippa’s marketplace, the majority of their listings are currently e-commerce sites, followed by content sites. There were not many SaaS businesses listed. Given this, if you are looking to sell a SaaS business, you will want to find an advisor with extensive experience in this space.

According to the listings on their website, FE International specializes in providing advisory services for SaaS, e-commerce and content businesses. These include Fulfillment by Amazon (FBA) businesses in various niches, other e-commerce businesses, affiliate and display advertising content sites and recurring subscription SaaS products. Their testimonial page outlines success stories from sellers across these three business models.

MicroAcquire works with any type of online business, but with a firm weighting towards low-value SaaS and eCommerce businesses. A good deal are not yet even profitable or were barely profitable. For example, many of the eCom listings had no asking price. They’re simply “open to offers”.

Of the 2,000+ listed businesses, the vast majority were SaaS or eCom with low revenue and very low asking price. Other types of businesses include crypto, mobile apps, and Shopify apps.

If you’re looking to sell a new startup fast, cheap, and easily, MicroAcquire is ideal. Just don’t expect a large multiple selling here.

Flippa also works with any online business or domain.

How Will They Value Your Business?

Having an accurate valuation is important when it comes to selling your business. If your business is valued too low, you are already on the back-foot in the eyes of buyers. The marketplaces and M&A advisors offer vastly different services, and the multiples are reflective of that.

According to its website, Flippa, “Uses your inputs and compares data to 1,000's of similar sites that have sold on Flippa. We look at business model, category, age and many other factors.”

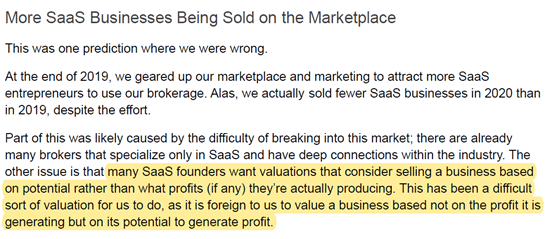

Empire Flippers notes that they use monthly EBITDA when valuing businesses. However, they add that valuing SaaS businesses is a challenge for them: “Many SaaS founders want valuations that consider selling a business based on potential rather than what profits (if any) they’re actually producing. This has been a difficult sort of valuation for us to do, as it is foreign to us to value a business based not on the profit it is generating but on its potential to generate profit.”

FE International has experience valuing SaaS, e-commerce and content businesses, and uses data from precedent transactions, along with historic price regression, revenue regression, and comparable sales analysis and discounted cash flow (DCF) modeling to value businesses. Also, FE has experienced valuation experts in-house who conduct these businesses valuations. This thorough analysis results in an accurate valuation. In fact, FE boasts an average delta of 5.8% between asking prices and selling prices, and a 94.1% success rate.

MicroAcquire’s business model focuses on speed, anonymity, and convenience. Therefore, you are almost on your own with due diligence.

The company does put in some effort to verify the seller’s identity, and customers can connect Stripe and other limited tools (e.g, Google Analytics) to verify revenue, traffic, time on page, etc.

However, due diligence is almost completely on the buyer. MicroAcquire does have an M&A expert directory where you can hire professionals to perform certain aspects of due diligence for you, though.

The good news is that if the business is new and cheap, you won’t need to perform much due diligence at all.

NOTE: if you use their white glove acquisition service, they will help with due diligence but you must pay a 5% fee.

Flippa doesn't have any of this.

How Successful Have They Been at Selling Your Type of Business?

Empire Flippers saw a great deal of growth in 2020, although most of that growth came from Fulfillment by Amazon (FBA) businesses. Based on their own data, they appear to be somewhat of a “one trick pony,” as they had little to no SaaS deals throughout the entire fiscal year. As evidenced in their 2021 State of the Industry report, they do not specialize in SaaS and are not set up to value SaaS businesses appropriately. Evidence suggests that their marketplace is primarily a spot for lower-end e-commerce FBA businesses, while slightly accommodating the content division (they saw low growth of only 7% in 2020).

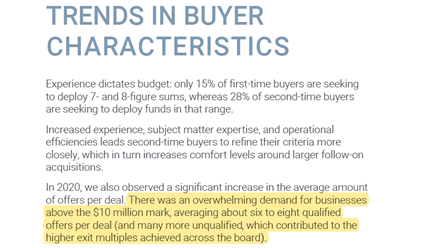

On the flip side, it seems sellers were increasingly migrating to M&A firms in 2020 – the difficult trading environment helped drive this, as sellers looking to exit did not want to leave value on the table during a time of uncertainty. FE International saw a hattrick in performance over the year. The M&A advisory firm saw record-high levels of SaaS, e-commerce and content acquisitions in 2020, including a 40% increase in SaaS acquisitions. Plus, according to Technology M&A: 2021 Outlook, they also saw a significant increase in the average amount of offers per deal. “There was an overwhelming demand for businesses above the $10 million mark, averaging about six to eight qualified offers per deal (and many more unqualified, which contributed to the higher exit multiples achieved across the board.)”

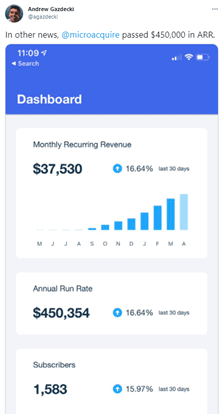

MicroAcquire did not publish a market report for us to draw accurate data from to discuss types of businesses sold. However, they published on their website that they have sold just over 500 businesses to date, and their CEO Andrew Gazdecki recently tweeted, “In other news, @microacquire passed $450,000 in ARR.” (Again, however, this is all from buyer subscription fees).

MicroAquire bills itself as the ideal marketplace for SaaS (low-value SaaS), and in their most recent market report, 2021 was a solid year for SaaS businesses on their marketplace. The average SaaS business was on the market for 127 days, and sold for a multiple ranging from 4 – 7x.

eCom was roughly similar. The average eCom business was on the market for 107 days and sold for a multiple between 3.4 – 7.8x.

With lower-value deals, it makes sense that marketplaces like MicroAcquire would bring in significantly less revenue than M&A advisors like FE International and Empire Flippers.

Nevertheless, they prove to be a good source for buyers looking for businesses at the start-up and proof of concept stage.

Flippa did not publish a report detailing any deal data, nor has any information been posted on their social channels.

Who Are Their Buyers?

Are there significant differences in the quality of buyers you'll encounter on different acquisition platforms? The short answer is, yes.

Flippa claims more than 300,000 registered buyers, but they do not openly state criteria the buyer must fulfill to be eligible to acquire a business on their marketplace. All they ask is that registered buyers and sellers complete ID verification. They also offer something called “Flippa Finder,” a service for first-time buyers. Through this service, the buyer will have a consultation with Flippa to discuss the goal of their acquisition. This service costs $50 plus a 2.5% acquisition fee (payable with any successful purchase). This service causes a conflict of interest, in they are profiting on both sides of the same acquisition.

MicroAcquire claims to have 100,000 registered users doing business on their platform. However, we don't have data on how many of those are buyers vs sellers today.

Further, a $390 annual fee is a low-cost burden for the level of access sellers may give away to buyers outside of a formal process, data rooms, etc. This causes security and IP concerns, as well as potential issues around the handling of client data, particularly in a GDPR and increased privacy-focused world.

As such, virtually all sellers will end up needing “middlemen” at some point in the exit or acquisition process. It's virtually impossible to execute a fair sale that is in a seller’s best interest without legal and financial counsel.

Empire Flippers share in their State of the Industry report for 2021 they currently have 190.7K active sellers and buyers, but they do not reveal how many of these users are buyers, nor how they define active. However, they note that their buyer network represents over a billion dollars in investable capital ($1,621,960,093.63 to be exact), which we would imagine is significantly more than MicroAcquire or Flippa.

One of the first steps of the Empire Flippers’ vetting process is for buyers to just to agree to the company’s Terms of Use. Buyers then must verify their identity and provide evidence that they have the funds they claim before they can retrieve any sensitive information about a listing. The buyers will then have 10 “unlock uses” to view listings based on their liquidity.

FE International recently shared that it has over 80,000 buyers in its network. According to their Technology M&A: 2021 Outlook report, their buyers are vetted for financial, operational and acquisition history/fit purposes before being marketed to on a deal-by-deal basis, and at last count (end of 2020) their network represented c.$20 billion in dry capital, “with a relatively equal distribution across e-commerce and content business buyers, and a larger sum for SaaS buyers.” They also have a track record of repeat high-end buyers, which comes at a great advantage to sellers: 28% of their repeat buyers have 7- and 8- figures to deploy. Because of this, you can expect their buyers to be accustomed to the use of NDAs, two-way vetting processes, data rooms, legal procedures and so on. Based on this, their service seems far better suited to high 6-, 7- and 8-figure acquisitions than MicroAcquire, Flippa or Empire Flippers.

Their CEO and founder, Thomas Smale, recently tweeted:

“Success rates are far lower when sellers are representing themselves/via a marketplace partly because there are a vast number of unqualified buyers out there whose only way to get a deal is by presenting themselves as legitimate (good M&A firms won't work with them!)”

What Do Past Clients Say?

Before selecting a marketplace or M&A advisor, you’ll want to do your research and hear what past customers have to say about their experience. You are going to be trusting this business to sell the fruits of your hard labor, and if others are posting about their negative experiences, this should be a red flag.

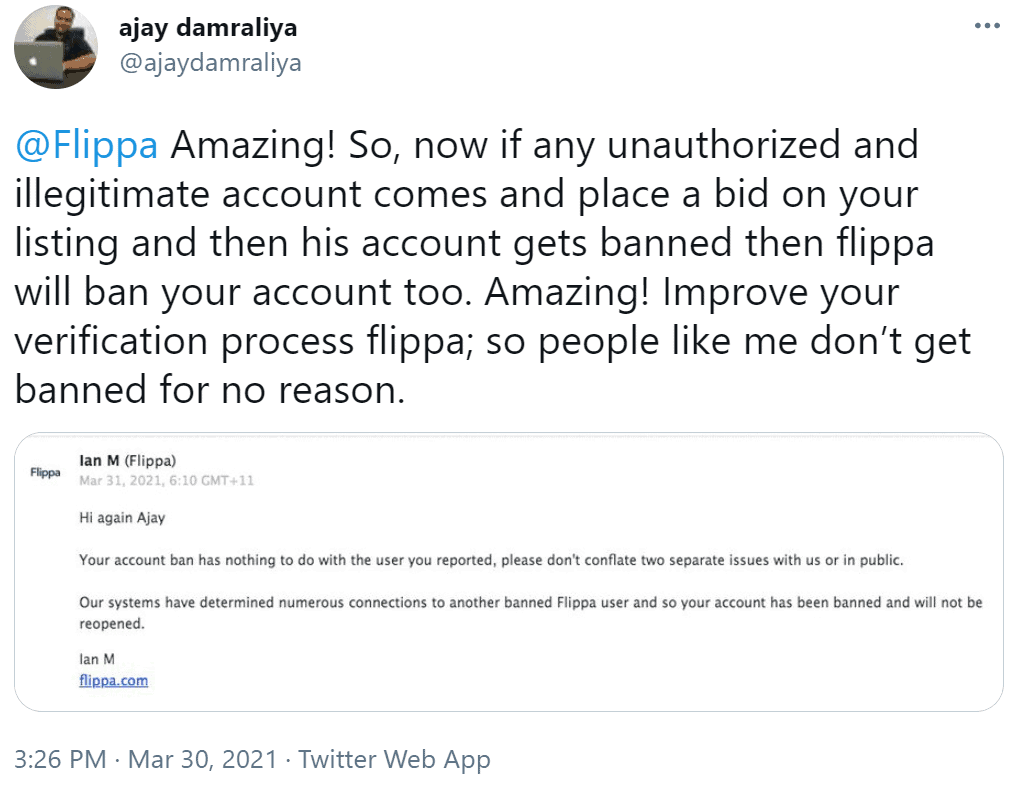

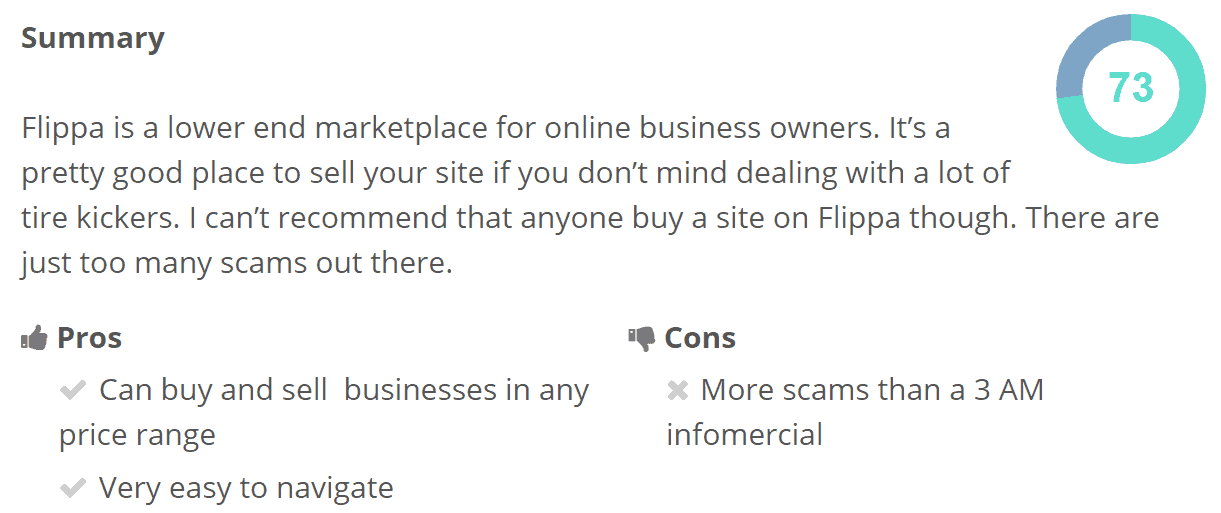

For example, Flippa has been in hot water recently, as clients complained that they were being pulled unfairly from Flippa’s online listings.

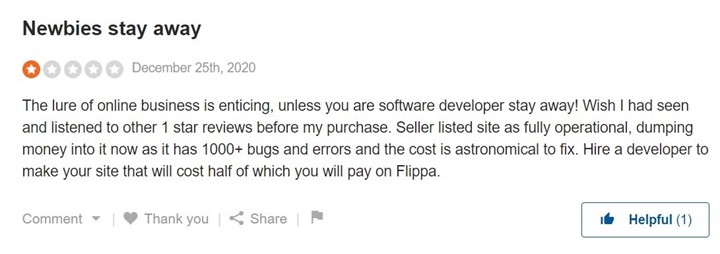

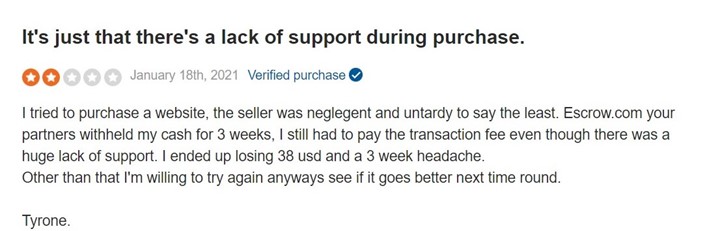

Other Flippa reviews:

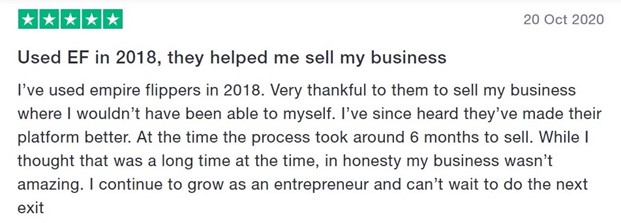

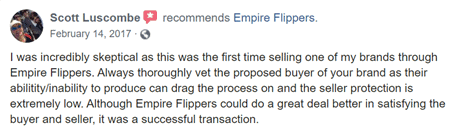

Empire Flippers reviews:

MicroAcquire reviews:

FE International reviews:

From FE’s testimonial page, YouTube channel, and social media accounts:

Dan Ni from ScaperAPI – FE International Review – YouTube

What’s the Takeaway?

Just as technology business opportunities have grown, so too have owners' options for selling them. There are so many that it is easy to get decision fatigue. Whoever you choose to sell through, you want to make sure you choose wisely: as we have laid out today, not every option is created equal.

Our suggestion? Choose a company you can trust that has data to back up their results, and avoid letting your business be the test-base.