Raise your hand if you own a website.

Now, keep it up if you’ve ever thought about selling it.

Selling a website can be tough. It’s your baby. It represents so much sweat equity. You’ve created it from basically nothing. Why would you ever sell it?

In short, money.

Not all websites are worth money, but if your site makes money consistently every month, you can sell it for a lot more than it makes.

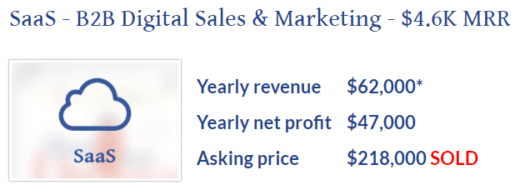

In fact, people do it all the time. Below is one of many examples of sites recently sold by leading website broker, FE International (there are hundreds like this):

It’s a relatively simple site. It makes $4600 a month. And it sold for $218,000.

Not bad right?

But how would you even start to approach selling your website?

You could list it on one of the big marketplaces, but assets can take forever to sell there, and you definitely won’t get a high multiple (a multiplier used to value a website—usually between 20x and 30x the monthly profit).

You could find a private buyer, but that’s an astonishingly huge amount of work. Plus, you’d have to take care of all the negotiations, finances, and legal work yourself (or spend major cash on a lawyer).

For our money, the best and easiest way to sell a site is through a website broker (there’s a much more robust business case for using a broker below).

There are just so many upsides. So, if you’ve got a website you think you might want to sell, this is a guide on how to choose the right brokerage.

What Is a Website Broker?

A lot of people don’t even know website brokers exist, but they do—just like yacht brokers, stock brokers, or real estate brokers.

And the function is pretty much the same: to connect buyers and sellers.

Of course, it can be a little more complicated than that with websites. Firstly, websites are digital assets, and sellers might never even see their buyers, and that can sometimes complicate things when people start kicking the tires.

It also takes a lot more financial and legal acumen to facilitate the sale of a website because, often, it is more a business than it is a tangible thing.

A good website broker will cover all these bases. They’ll understand how to properly “kick the tires” of a website. They’ll have legal and financial teams. And a broker understands that what they’re selling is a business, and they’ll treat it that way.

Should You Use a Website Broker?

If you want to sell your website, there aren’t many reasons not to use a broker. That said, using a broker isn’t the right decision 100% of the time. So before we really dig into how to choose the best website broker for your business, let’s quickly run through the rationale of using one at all.

Question #1: How much is your website worth?

In general, website brokers sell sites in the mid-to-high ranges.

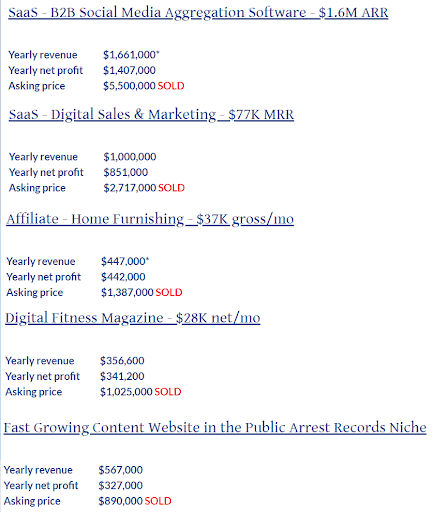

For a website brokerage like FE International, one of the premier website brokers on Planet Earth, that range is in the $20,000 to $20,000,000 range. Here’s a quick sample of some of their recently sold listings.

Now, if you’re thinking “$20,000?! That’s a ton of money! There’s no way my site could be worth $20,000!”

You might be wrong.

A website brokerage like FE International routinely sells businesses for 2.5x – 4.5x the annual profit, and a high-quality site that generates mostly passive income can sell for even higher. At that multiple, your site really only needs to be generating about $670/mo to break that $20,000 bare minimum barrier.

Of course, a lot of you probably have websites that earn much, much more than that, so you may not have that problem.

Question #2: Can you find buyers on your own?

The other main reason to use a website broker is that they typically have access to large pools of qualified buyers.

Let’s say you have a website that earns about $2,000/mo. At a benchmark 2.5x multiple (of annual revenue), you might be able to offload that site for about $60,000. For a super high-quality site, that number might jump to $80,000.

Do you have many friends who are able to spend $80,000… like today?

I know I don’t.

Brokerages do. They are in the business of buying and selling websites. FE International, for example, has over 650 transactions under its belt. You don’t make that many sales without developing a network of people who want to buy websites.

At top brokerages, sometimes websites don’t even make it to the public listings; instead, they’re snatched up by the piranha pool of rabid website buyers before they ever see the light of day.

This is especially true with content sites. Content sites (sites monetized with content and display ads or affiliate revenue) tend to sell quickest because they tend to be by far the most passive kind of website.

That’s what most of us build, right?

The point is: Instead of hunting down buyers on your own, a broker can probably sell your website way faster than you can.

Question #3: Are you equipped to handle contracts and money transfers?

This is a big one for most folks.

As nerve-wracking as it is for you to sell your website, it’s probably worse for the person letting go of that $60,000 (or however much your website goes for).

You’re going to need air-tight legal contracts that make all parties comfortable and keep everyone safe.

You’re also going to need proper valuations, a platform for negotiations, and some sort of escrow system to safely transfer the assets.

I’m sure you could figure out how to do all this, but if you don’t know how and don’t want to figure it out, using a website broker might alleviate a major pain point.

Question #4: Can you handle the technical transfer?

This was a big one for me when I first started buying and selling websites. I remember buying a site on one of the bigger marketplaces instead of going through a broker.

If you didn’t know, when you make a purchase through one of those marketplaces, even after you’ve negotiated a price and settled the money, you’re 100% on your own when it comes to the actual technical transfer of the asset.

The problem was neither of us—myself nor the seller—knew the first thing about how to transfer ownership of a website.

So there I was, out several thousand dollars, sitting on my hands with no money and no website. We eventually figured it out, but it was not a fun couple of days.

Brokers help you get around this issue.

Most website brokerages will have a technical team that can help take care of the transfer, and, as much as they’re able, they’ll transfer the money and the asset at the same time.

This also adds an extra layer of security, since the technical part of the asset transfer is arguably the highest-risk part of the whole deal.

So, Should You Use a Website Broker?

For my money, the answer is almost always yes.

There is one downside: fees.

Top tier brokerages typically charge 10-15% commission for their role in facilitating the sale of a digital business; however, you can almost always make that up in the increased prices brokerages typically command, which = a net higher profit for you.

So, yes, I’d say it’s almost always worth looking at a good broker before you try to sell a website on your own.

The advantages are just too good to ignore:

- It massively reduces risk for everyone involved

- Brokers typically have access to way more buyers (and ones with way more money) than you do, making it easier for them to sell a site more quickly

- Brokers almost always command higher prices

- And brokers can help with the legal, financial, and technical challenges of a digital asset sale

At the very least, it’s worth looking into.

How to Choose a Website Broker

So you want to use a broker. Good call. How do you find a good one?

There are tons of brokers out there, and many of them do a good job. So let’s take a quick quiz to try to play matchmaker.

Question #1: How much is your website worth?

Probably the first question you need to be able to answer is “How much is my website worth?”

You don’t need to know precisely. But you do need to know roughly before spending a bunch of time talking to buyers and brokers (brokers have their own sophisticated formulas for site valuations).

You need to know this ballpark valuation figure because different brokers will cover different parts of the market. A more hands-on, marketplace-style platform (like Websitebroker.com) might be best for deals under $20,000, while a brokerage like FE International handles more “up-market” deals in the $20,000 – $20,000,000 range.

At a very general level, a website is worth roughly 30x its monthly profit; however, that’s based on lots of factors, and some sites can capture higher multiples if they have features like the following:

- A long and consistent history (FE International, for example, requires at least one year of “successful financial history”)

- They are passive (i.e., <20 hours/month of owner involvement)

- They have a strong history of growth (and growth is trending upward)

- …and more (discussed below)

As a benchmark, you can use the simple formula: annual profit x 2.5.

If your business is super passive or has any of the other qualities listed above, you might be able to bank on a bit higher price.

But really, you mostly just need to know if your site is over the $20,000 mark. If it is, I’d recommend getting a free site valuation like this one at one of the major website brokerages.

So here’s an answer. If your website is worth $20,000 or less, consider:

And if your website is worth $20,000 or more:

Question #2: How much help do you want?

Do you want to save a bit of money on fees, or would you prefer to have the most professional possible experience?

I think most of us will probably fall in to camp “I want the best service.”

If we’re using a website broker, we’re doing it because we want all the extra assistance. So, when I sell sites, I don’t worry much about fees. Instead, I’m way more concerned with the quality of the help.

So you’re really looking for a website brokerage that:

- Has the infrastructure in place to actually provide help at all stages of the sale

- One that has been around a long time, and

- One that has a strong professional reputation

The brokerage who has arguably the best combination of infrastructure, history, and reputation is FE, although iAcquisitions don’t do a bad job either (from what I hear).

I don’t recommend some other firms that I won't name here. I’ve heard too many horror stories—and ones specifically on the technical and legal side—to feel comfortable recommending some of them.

Question #3: How long are you willing to wait?

If you were going to, say, sell on a big marketplace like Flippa, there’s a good chance you’d be staring at your computer screen watching your auction expire without any bites from serious buyers.

One of the main advantages of using a brokerage is their ability to move products.

So, if I were setting out to choose a website brokerage, I’d strongly prefer those who have big lists of buyers to sell to.

And I don’t just mean big audiences or lots of website traffic. I mean email lists of dedicated buyers who are serious about purchasing websites (or, in some cases, brokerages will also buy businesses directly – somewhat of a conflict of interest).

Compiling a list of qualified buyers isn’t easy. It takes many years to develop, and often you’re just going to have to ask the brokers themselves how many vetted buyers are in their database.

So, if I were you, I’d send a quick email to the brokers you’re considering.

A List of the Best Website Brokers

1. FE International

FE International was founded by Thomas Smale in 2010 and quickly became one of the premier brokerages for up-market online businesses. Today, I’d say FE is probably the best overall choice for sites valued between $20,000 and $20,000,000.

All told, at the time of writing, FE has brokered over 650 deals (that amounts to hundreds of millions of dollars in sales, if you were wondering). At 650 total deals and counting, FE is widely considered the most active broker in the industry.

They also may be the biggest. Currently, they have a team of over 40 people, including finance, technical, and marketing experts. FE has its headquarters in New York but also has offices in Boston, London, Ho Chi Minh City, and Singapore.

If you’re curious about the kind of work FE does, you can check out some of their recent listings here.

Use them if…

- You want the best possible service. There are lots of good brokers out there, but FE is likely the most professional and has the most robust team. They can find buyers and can afford to be very hands-on at every part of the process. They boast a 94.1% sales success rate, and most deals are completed quickly, especially when compared to marketplace sites.

- You have a high-value, high-quality site. FE is usually the best suited for sites in the $20,000 – $20,000,000 range. In fact, FE can be pretty picky about the websites they choose to sell. They only offer their buyers the highest quality assets, and you’re not likely to get your site listed if it’s not built well.

- You want the highest possible asking price for your site. Because FE is a premier brokerage, they generally command the highest prices. This does not mean they have trouble moving sites; on the contrary, they often sell sites before they even reach the public listings. But people buy through FE because they are experts at what they do, and they can be confident the inventory is solid. That generally equates to higher prices.

Don’t use them if…

- Your site isn’t quite worth $20,000 yet. Even if you’re on your way, FE usually doesn’t handle sales below this threshold. I’m sure they could, but remember: they are a well-staffed, hands-on operation paying a staff of 35+ experts. They have to keep the lights on, and It’s tough to do that on commissions from $5,000 sites.

- You don’t have a quality site. Everyone has a different definition of “quality,” and I’m sometimes shocked by people who think they have a quality site but don’t. In general, if you have bad or duplicate content, technical glitches, or are in questionable niches (gambling, etc.), FE will probably suggest you sell elsewhere.

- You’re not comfortable paying high commissions. FE’s commissions are very reasonable for what you get, and they’re in line with other premium brokers, but at 15%, they’re on the high side. Because FE is so good at selling sites (and for higher prices), you’re really spending money to make money. Still, these kinds of commissions might turn off the penny pinchers among us.

2. Websitebroker.com

Not a lot of people know about Websitebroker.com, which is why I kind of consider it a diamond in the rough—a little gem of a marketplace that accomplishes what Flippa sets out to do, only without the absurd levels of spam and scams.

It’s important to note Websitebroker.com isn’t technically a brokerage; it’s a marketplace (read more about the difference between marketplaces and brokerages here). So, it’s more or less the polar opposite of a firm like FE International.

But it nicely covers the parts of the market below what higher-tier brokers capture, and even though it’s not as well-known, there are plenty of buyers using the platform—certainly enough to get your site sold.

Use them if…

- You have a website worth $20,000 or less. In fact, it’s the main selling point of this platform: the buyers here are downright hungry for sites in this price range.

- You’re comfortable handling technical and legal stuff yourself. Again, this isn’t a brokerage, so you’ll be forfeiting a lot of the help you’d get by using one. That said, selling a site in this price range usually has lower stakes than those at higher prices, and not everything needs to be hammered out in a contract like it might with a $500,000 asset transfer.

- You’re a site flipper. If you’re a site flipper—someone buying sites privately and flipping them on marketplaces for a profit—this is a really, really good marketplace that your competitors may not know about. It can expand your potential reach and help you get that asset off the books.

Don’t use them if…

- You really want a high multiple. This is the case with any marketplace, really. Sites sold through brokers can sometimes fetch multiples as high as 50x monthly profit (usually highly passive, highly profitable sites). It’s possible to get that in a marketplace if you have a really nice site and you market it well, but in my experience, it’s certainly not the norm. It’s more realistic to plan on multiples in the 20x – 29x monthly profit range.

- You’re not comfortable with contracts or technical stuff. This shouldn’t be a huge surprise. If you sell a site through a marketplace, you’re going to be on the hook for stuff you wouldn’t be responsible for if you sold through a website broker. For me, the technical side of transferring a site can be a bit of a pain, and if a website is particularly large or complicated, it just isn’t worth it (although for simple sites, it usually isn’t that big a deal).

3. iAcquistions

iAcquisitions is another broker that serves the upper end of the market. They’re not quite as active or experienced as FE, nor do they have as big and global a team, but they are quite well regarded in the industry.

Their big selling point is mostly that they’re “entrepreneurial,” which, to them, means they have actual experience building and selling their own sites. And honestly, this, to me, is a pretty big benefit. A few brokers have lots of financial acumen, but not many have been down in the trenches, which can sometimes make it easier to understand, value, and sell a business.

Use them if…

- “Entrepreneurialism” is important to you. This might be a draw for some of you, especially if you’re the type who feels like your business is your “baby”; you might just… feel better selling through a broker who puts stock into building a team of entrepreneurs.

- You have a higher-value e-commerce site. iAcquisitions certainly isn’t the only broker who can sell an e-commerce business, but this is definitely an area of strength.

- You have an Amazon FBA business. While this may not include many of us, it might include some. Their experience selling Amazon FBA businesses falls in line with their e-commerce expertise.

Don’t use them if…

- You don’t meet the minimum requirements for a premium brokerage. Same story here, really: iAcquisitions serves the middle and upper end of the market and is picky about the sites they sell.

- You’d be more comfortable with stronger financial expertise. Other website brokerages—FE International in particular—appear to have much stronger financial expertise, which would make a lot of people (me included) more comfortable.

4. Flippa

Ah… good ol’ Flippa. No, they’re not a brokerage. Yes, they have a somewhat troubled reputation. Still, selling sites on Flippa isn’t all bad, all the time. In fact, it can be a damn good place to do it in some cases.

Like Websitebroker.com, Flippa is a marketplace (i.e., not a pure brokerage). But it’s not just any marketplace; it’s the biggest and oldest website marketplace there is. It was started by a guy named Mark Harbottle in 2009 and became one of the few website marketplaces in existence, launching its user base into the stratosphere.

Of course, that kind of growth + the inherent problems of a marketplace = lots of problems.

In Flippa’s case, those problems mostly manifest in the form of scams and spam. It’s not their fault. They do a lot to stop it. But it’s still a problem.

Luckily, though, it’s much less of a problem for sellers than it is for buyers (i.e., it’s a lot easier for a seller to scam a buyer than the other way around). It’s generally pretty safe for sellers as long as you use Flippa’s escrow system.

Here are a few other pros and cons.

Use them if…

- You want to roll the dice. Flippa is not a place where you get a sophisticated valuation. It’s an auction. You can set a reserve price and a “buy it now” price, but it’s still an auction. But, as is the case with any auction, if you want people to start bidding, you generally need to entice them. However… it’s also very possible for people to get into a bidding war and for the dollar signs to multiply before your eyes. This is certainly more likely if you have a very well-built site in a good vertical on a solid growth curve, but really, it’s at least a slim possibility for any auction.

- You want access to the biggest possible audience. Flippa undeniably has the biggest audience of any website sales platform. At the time of writing, SimilarWeb estimates they get 1.82 million visitors per month. Premium brokerages like FE tend to have better lists of targeted buyers with real money to spend, but on Flippa, you definitely have access to more eyeballs.

- You can (or want to) promote your listing yourself. If you have a network of people who might potentially want to buy your site, it’s possible to use Flippa as the sales platform and to use their bids to up the price. If one of them happens to win the auction, you also have an escrow system in place to facilitate the transfer.

Don’t use them if…

- You want any help at all. Again, this is not a brokerage. No one’s going to hold your hand here. If there is anything—anything at all—that a buyer wants to be included outside of the basic set of website assets (e.g., domain, hosting), you’re going to have to either settle for a non-binding “gentleman’s agreement” or hire a lawyer of your own. Likewise with technical stuff; you’ll have to be able to transfer the website on your own as well.

- You’re not comfortable with public scrutiny. One of the main advantages buyers have on Flippa is the ability to ask questions to site owners both collectively and publicly in the form of a comments section on the listing. If you’re selling a site on Flippa, you can expect quite a bit of scrutiny from potential buyers. If you don’t want to answer questions about your business on a public forum, this might be a turn-off.

- You want the best price for your business. While it’s certainly possible to fetch a healthy multiple for your website on Flippa—in a “roll the dice” kind of way mentioned above—it doesn’t appear to be the norm. Based on anecdotal evidence only, most businesses seem to sell for 20x-25x monthly profit multiples on Flippa, and there’s no real way to know what people will be willing to pay. Usually, though, you can expect to fetch less money on Flippa than you could with a brokerage, where they have access to heavy-hitting buyers who likely know them and are comfortable buying from them.

5. Latonas

Similar to FE International, Latonas is another brokerage that serves the mid to upper end of the market. They’ve been around for about the same amount of time and sell sites in the same general price range, although they have fewer deals under their belt than FE does.

One of the unique things about Latonas is that they are the only “premium” brokerage to facilitate the sale of domain portfolios, an asset class usually found on down-market platforms like Websitebroker.com.

Use them if…

- You’re a domain flipper. Most of us are probably site builders—people who build sites and try to turn them into revenue-generating businesses. There’s a whole different set of folks who buy, sell, and flip domains. Most domain resellers use platforms like Flippa. Having access to a broker is a luxury for a domain flipper, and it could be a draw if you have a portfolio of high-value domains you want to unload.

- You have a smaller site. Of all the premium brokerages, Latonas is the one who seems to sell the most sites at the lower end of the price range. Because it’s sometimes difficult to find brokers willing to work with you if your site’s worth less than, say, $20,000, Latonas is possibly the best option if you have a smaller site and still want to work with a brokerage.

Don’t use them if…

- You want to move your site quickly. This is based purely on hearsay (and also a bit on monitoring listings on most of the website brokerages myself), but businesses seem to sit on Latonas longer than they do on other brokerages. That’s not to say they don’t move anything—just that they don’t have the feeding frenzy-like efficiency of a brokerage like FE International.

What happens after you pick a broker?

What happens after you pick a broker, and decide to list your website, will depend largely on the broker. But in general, here’s more or less what you can expect.

You’ll send financial proof, and due diligence will be conducted.

This is mostly common sense: the first step before anyone invests any real time into your site—whether they’re a buyer or a broker—is for you to prove all the numbers are real.

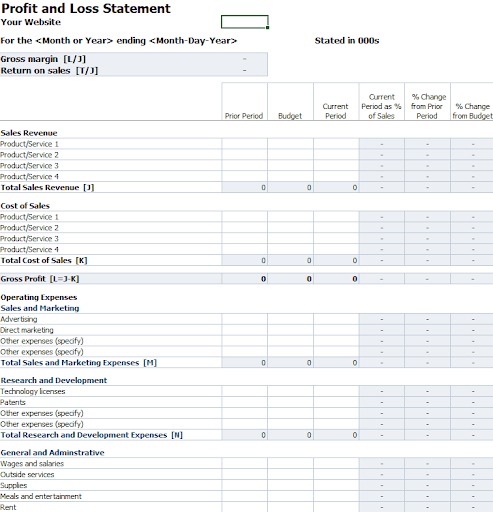

The most basic way to prove the numbers is a simple profit and loss statement (usually in the form of an excel spreadsheet or a report by whatever accounting software you use.

(Source: Author’s Screenshot/Microsoft Office)

The due diligence process typically involves a more robust verification process of those same numbers and more scrutiny of the business model—you’ll need to prove the traffic is real and the revenue is real.

There are many ways to do this, but most brokerages implement some combination of:

- Back-end access to accounts associated with traffic and revenue sources, and/or

- Live video walkthroughs.

For larger businesses, you might also expect to hand over bank statements and tax returns.

Due diligence might also include scrutiny of the moving parts of the business. You might answer questions about a drop in revenue or systems you’ve created. Or you might show the prospective buyer your ad campaigns, so they understand the mechanics of what they’re buying.

Overall, due diligence is a flexible term, and it can mean different things for different businesses. Most brokerages have their own due diligence process, but if you want to get an idea of the basics, here is an article from FE International founder Thomas Smale that outlines the process.

The brokerage will list and market the business.

After the due diligence process, the broker will list the business, and, most of the time, especially at premium website brokerages, they’ll market it for you.

Because the top-tier brokerages have networks of buyers who are always looking for sites, the first step is often to reach out to those folks to see if there’s any interest, or, in the case of some firms, a brokerage might actively go hunt buyers down.

Of course, brokerages typically also have websites and audiences where they list sites concurrently.

You’ll negotiate and close the deal.

If a buyer is interested, you’ll begin the negotiation process.

This is typically a back-and-forth process, but most of the time, the brokerage will have attached a valuation number to your business, and the conversation will start there.

A buyer might negotiate the price down, or try to negotiate for something else: for example, some buyers ask for extended training from the seller or for other assets to be included in the sale.

You’ll transfer the asset, and the buyer will transfer money.

The last step is the transfer.

Most brokerages have an escrow system. They’ll have teams to facilitate both the transfer of the technical assets and the remittance of the funds.

After the transfer, you’ll tie up any loose ends you agreed to take care of during negotiation.

How can you increase the value of your website?

We’ve been throwing out numbers from the beginning of this post—to quote myself, “On a very general basis, a website is worth roughly $30x its monthly profit…”

But how do we increase that number? How can we sell our business for the highest possible multiple?

In general, these are the things that increase the multiplier:

Passivity:

The more passive a business is, the more valuable it is. For example, something like a consulting service, where more owner participation is required will generally have a lower multiple than a content-driven website that only requires a handful of hours per month.

In practice: To increase passivity, develop good, automated systems that won’t require a lot of input from a new owner.

Simplicity:

Simple businesses also tend to fetch higher multiples. Something like a SaaS business, for example, might require a developer, customer service department, and ad campaigns. Compare that to an SEO-driven affiliate blog that essentially just has to hit the publish button.

In practice: This may not be something you can necessarily accomplish easily, since the simplicity relies a lot on the business model itself. That said, simplicity also comes from good processes and an efficiently run business, so investing in Standard Operating Procedures (SOPs) and quality employees/freelancers is also a good idea.

A Strong History:

Businesses with a strong history typically fetch higher multiples. In other words, a business who’s been online and profitable for five years will usually be worth more than the business who had a great first year but has no other history (all else being equal, of course).

In practice: This probably comes down to timing; unless you have people beating down your door to buy your site, it can pay to wait. Not only will you likely sell your website for more, but you’ll also benefit from the revenue it makes in those interim years. If you’re patient and your business is strong, it’s not out of the question to 2x or 3x your money this way.

Growth:

Sites on an upswing generally sell for more than those riding a decline. There are specialized buyers looking to snag businesses in trouble and fix them, but they’re a small group, and in general, buyers prefer businesses showing growth.

In practice: This is probably also about timing—but also a little about effort. If your business is in a slump, it’s probably not a good time to sell it. Instead, fix it. And if you can’t or don’t want to fix it, it’s probably worth forking over some cash to pay someone to fix it for you, since you’re likely to more than make up the cost when you sell.

What do you think?

Do you have a digital business to sell? What questions do you have? Which website broker are you leaning towards?